The Role of Telematics in Personalized Car Insurance Pricing

Understanding Telematics and Car Insurance Discounts

So, you've heard about telematics, right? Maybe a friend mentioned it, or you saw a commercial. Basically, it's a way for your insurance company to track how you drive. Sounds a little Big Brother-ish, I know, but hear me out. It can actually save you money on your car insurance! Telematics devices, sometimes called "black boxes" or "dongles," plug into your car's OBD-II port (usually under the steering wheel) or work through a smartphone app. They record things like your speed, braking habits, acceleration, and even the time of day you're driving. Insurance companies then use this data to assess your driving risk and offer personalized discounts. Think of it as a report card for your driving – ace it, and you get rewarded with lower premiums.

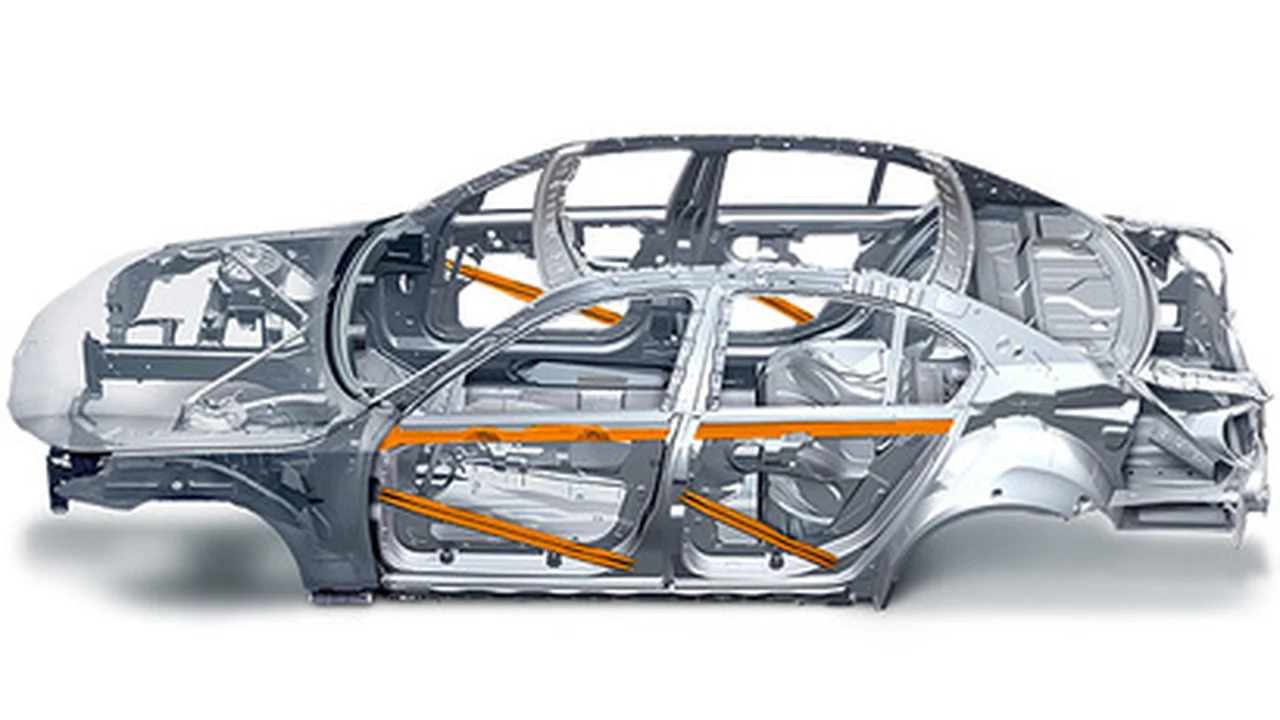

How Telematics Works: The Nitty-Gritty Details

Okay, let's break down how this whole telematics thing actually works. The device, or the app on your phone, is constantly collecting data while you're driving. This data is then transmitted to the insurance company. They use algorithms and fancy software to analyze your driving habits. They're looking for things like hard braking (slamming on the brakes!), rapid acceleration (pedal to the metal!), speeding (duh!), and late-night driving (statistically riskier). Some systems even track things like how often you use your turn signals. The better your driving habits, the lower your risk profile, and the bigger the potential discount. It's a pretty transparent system, and most companies will give you access to your driving data so you can see how you're doing.

Telematics Devices and Smartphone Apps: A Comparison of Options

You've got two main choices when it comes to telematics: dedicated devices and smartphone apps. Dedicated devices, like the ones provided by insurance companies, usually plug directly into your car. They're generally more accurate and reliable because they're specifically designed for this purpose. They don't rely on your phone's battery or GPS signal. Smartphone apps, on the other hand, are more convenient. You probably already have your phone with you when you drive, so there's no extra hardware to worry about. However, they can be less accurate and drain your phone's battery. Plus, you need to make sure the app is running correctly every time you drive. Ultimately, the best choice depends on your individual needs and preferences.

The Benefits of Using Telematics for Car Insurance: Savings and Safety

The most obvious benefit of telematics is the potential for savings. Insurance companies offer discounts ranging from a few percent to as much as 30% or more, depending on your driving habits. But it's not just about the money. Telematics can also make you a safer driver. Knowing that your driving is being monitored can encourage you to be more cautious and avoid risky behaviors. Some systems even provide real-time feedback, alerting you to things like speeding or hard braking. This can help you improve your driving habits and prevent accidents. Plus, in the event of an accident, telematics data can provide valuable information to insurance companies and law enforcement.

Potential Drawbacks of Telematics: Privacy Concerns and Data Usage

Okay, let's be real. There are some potential downsides to using telematics. The biggest concern for many people is privacy. You're essentially allowing your insurance company to track your every move. While they promise to only use the data for insurance purposes, it's understandable to be wary. It's important to read the fine print and understand how your data will be used and protected. Another potential drawback is data usage. If you're using a smartphone app, it can consume a significant amount of data. Make sure you have a data plan that can handle it. Also, some systems may penalize you for certain driving behaviors, even if they're unavoidable. For example, if you live in a city with lots of stop-and-go traffic, you might get dinged for hard braking, even if it's not your fault.

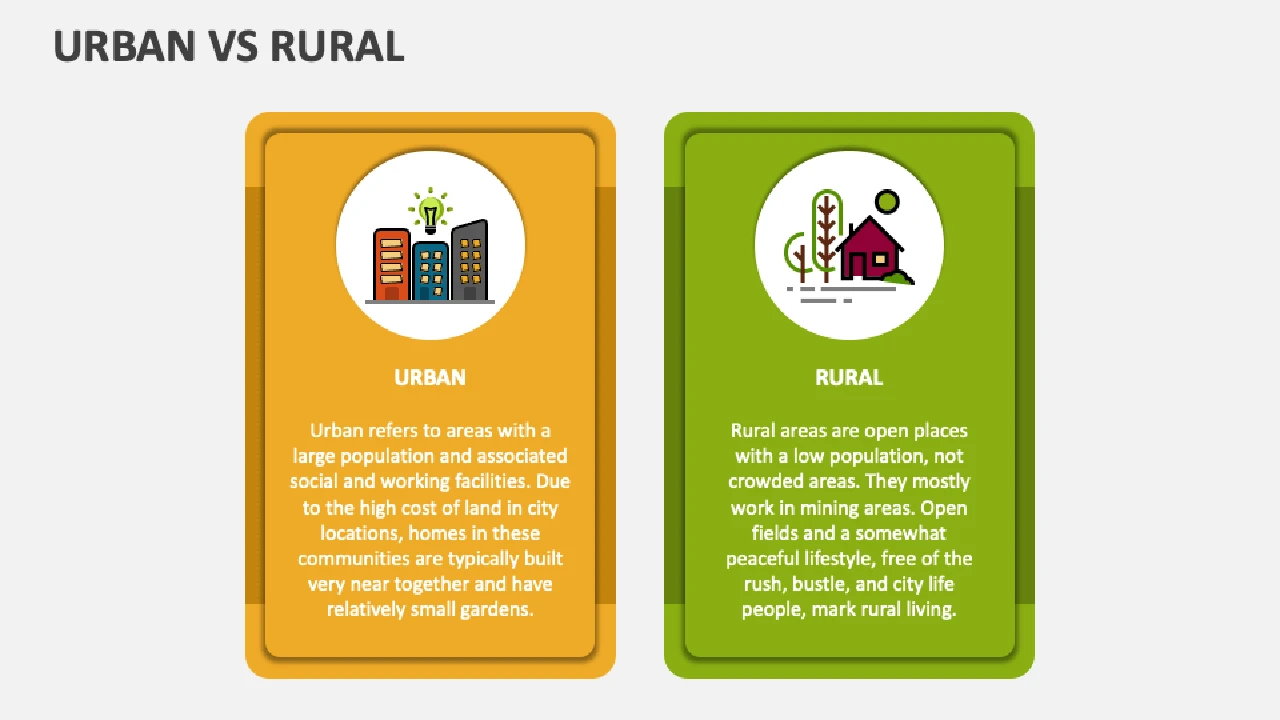

Telematics and Different Driving Scenarios: City vs. Highway

The effectiveness of telematics can vary depending on your driving environment. If you do most of your driving in the city, you might see more benefits from telematics. City driving typically involves more starts and stops, more turns, and more opportunities for risky behaviors. Telematics can help you identify and correct these behaviors. On the other hand, if you do most of your driving on the highway, the benefits might be less pronounced. Highway driving is generally more consistent and predictable. However, telematics can still help you monitor your speed and prevent drowsy driving. It really boils down to *how* you drive in each environment, not just *where* you drive.

Telematics and Car Insurance for Young Drivers: A Smart Choice?

Telematics can be especially beneficial for young drivers. Young drivers are statistically more likely to be involved in accidents, so they typically pay higher insurance premiums. Telematics can provide them with an opportunity to demonstrate that they're safe drivers and earn discounts. It can also help them develop good driving habits early on. Many parents are using telematics to monitor their teenage drivers and provide feedback. It's a great way to promote safe driving and reduce the risk of accidents. Just be sure to have an open and honest conversation with your teen about the purpose of telematics and how the data will be used.

Telematics Devices: Product Recommendations, Features, and Pricing

Alright, let's talk about some specific telematics devices and apps. Keep in mind that availability and features can vary depending on your insurance company and location.

H2 Progressive Snapshot: A Popular Choice for Insurance Discounts

Progressive Snapshot is one of the most well-known telematics programs. It uses a small device that plugs into your car's OBD-II port. It tracks your driving habits and provides personalized feedback. The discount you can earn depends on your driving performance. Progressive Snapshot is generally considered to be user-friendly and effective.

- Features: Tracks mileage, hard braking, rapid acceleration, and time of day.

- Usage: Plug the device into your car's OBD-II port. Drive as you normally would. Check your progress online or through the mobile app.

- Comparison: Snapshot is a good all-around option with a straightforward discount structure. It's especially suitable for drivers who are generally safe but want to fine-tune their habits.

- Pricing: Free to use. The discount you receive depends on your driving performance.

H2 Allstate Drivewise: Earn Rewards for Safe Driving Habits

Allstate Drivewise is another popular option. It's available as both a device and a smartphone app. It tracks similar data to Progressive Snapshot, but it also offers rewards for safe driving habits, such as gift cards and discounts on merchandise.

- Features: Tracks mileage, hard braking, rapid acceleration, and time of day. Offers rewards for safe driving.

- Usage: Download the app or plug in the device. Drive as you normally would. Earn points for safe driving and redeem them for rewards.

- Comparison: Drivewise is a good choice if you're motivated by rewards and want to earn more than just insurance discounts.

- Pricing: Free to use. The rewards you earn depend on your driving performance.

H2 State Farm Drive Safe & Save: Personalized Insurance Rates Based on Driving Data

State Farm Drive Safe & Save uses a smartphone app to track your driving habits. It offers personalized insurance rates based on your driving data. It's a good option if you're already a State Farm customer.

- Features: Tracks mileage, hard braking, rapid acceleration, time of day, and distracted driving.

- Usage: Download the app. Drive as you normally would. Your insurance rate will be adjusted based on your driving data.

- Comparison: Drive Safe & Save is a good choice if you're a State Farm customer and want a personalized insurance rate.

- Pricing: Free to use. Your insurance rate will be adjusted based on your driving data.

H2 Liberty Mutual RightTrack: Control Your Car Insurance Costs With Telematics

Liberty Mutual RightTrack offers a discount for signing up and a potential discount based on your driving behavior. You use a plug-in device for a set period, and your discount is then applied.

- Features: Tracks mileage, hard braking, and time of day.

- Usage: Plug the device into your car for a set period. Your discount will be calculated based on your driving.

- Comparison: RightTrack offers a guaranteed discount for signing up, which makes it an attractive option.

- Pricing: Free to use. Offers an initial discount for signing up and a potential discount based on driving.

The Future of Telematics and Car Insurance: What to Expect

Telematics is constantly evolving. We can expect to see more sophisticated systems that track even more data, such as distracted driving and drowsy driving. We can also expect to see more integration with connected car technology. In the future, your car might automatically share driving data with your insurance company, without you having to do anything. Telematics is also likely to play a bigger role in usage-based insurance (UBI), where you only pay for the miles you drive. This could be a great option for people who don't drive very often. The future of telematics is bright, and it's likely to have a significant impact on the car insurance industry.

Telematics: Is It Right for You? Factors to Consider

So, is telematics right for you? It depends on your individual circumstances. If you're a safe driver and you're comfortable with sharing your driving data, then telematics can be a great way to save money on your car insurance. However, if you're a risky driver or you're concerned about privacy, then telematics might not be the best choice. Before signing up for a telematics program, be sure to read the fine print and understand how your data will be used. Consider your driving habits, your privacy concerns, and your budget. Weigh the pros and cons carefully before making a decision.

:max_bytes(150000):strip_icc()/277019-baked-pork-chops-with-cream-of-mushroom-soup-DDMFS-beauty-4x3-BG-7505-5762b731cf30447d9cbbbbbf387beafa.jpg)